It’s hard to fault a CEO who grows a company beyond $1 trillion in value. Elon Musk managed the feat by upending the automotive market with Tesla’s TSLA electric vehicles and extended its lead with broader battery power. And yet now, when it’s time to trust more in the corporate equivalent to autopilot, he is steering haphazardly into an incipient trade war, the potential loss of government subsidies and customer alienation.

The financial results Tesla unveiled on Wednesday are almost beside the point despite how bad they were. Gross profit margin at the company’s core automotive business, excluding regulatory credits, fell below 15% to less than half their peak in 2022. The drop occurred despite costs per car falling yet again, to below $35,000, excluding leases, in the seventh straight quarter of such improvement. The average price, however, also tumbled below $40,000, down almost a third from the mid-2022 peak.

It may be a bad omen. Electric-vehicle sales in Germany, where Tesla has built a European “gigafactory,” plummeted nearly 40% market-wide in December, according to industry group ACEA. Berlin scrapped subsidies for clean vehicles, and U.S. President Donald Trump is threatening to do something similar, with Musk fully behind him.

The political fallout could exacerbate problems. Tesla’s share of the U.S. EV market slipped again in the final three months of 2024, to 44%, according to research firm Cox Automotive. Its promised autonomous car, the Cybercab, is an oddity of design that fits unclearly with function, but the company emphasizes that new, more affordable models are coming soon. Musk also has spread himself even thinner by adding the White House to his responsibilities guiding space, social-media, artificial intelligence and neurological ventures. Embracing far-right lawmakers might scare away his eco-conscious base.

Everything may yet work out. Tesla’s energy storage unit doubled sales. The end of subsidies could fatally weaken competitors. Political favoritism also has its perks, and the company’s self-driving system – if it works – really should be more flexible than what rivals can deliver. AI breakthroughs also herald improved economics for the vehicle technology.

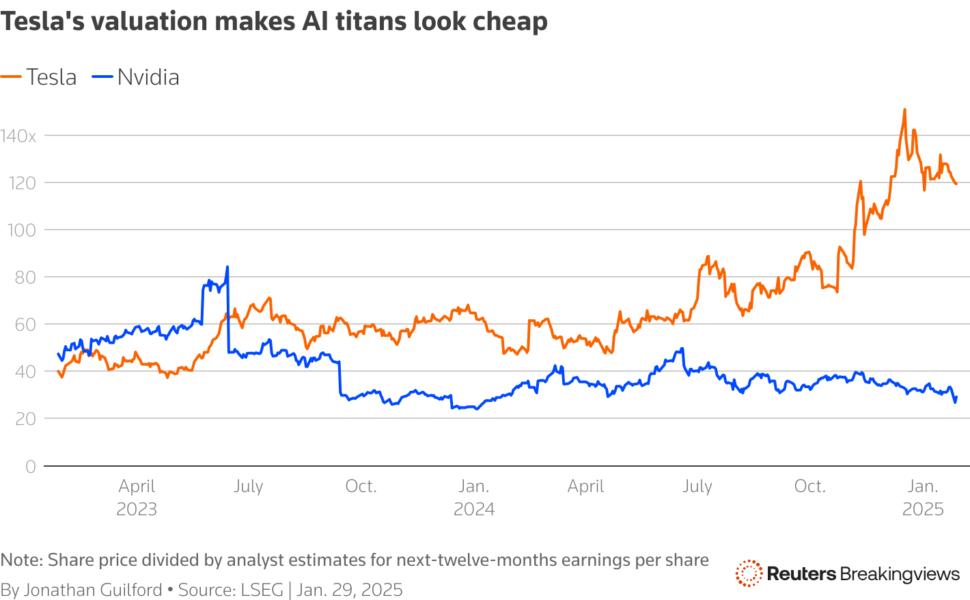

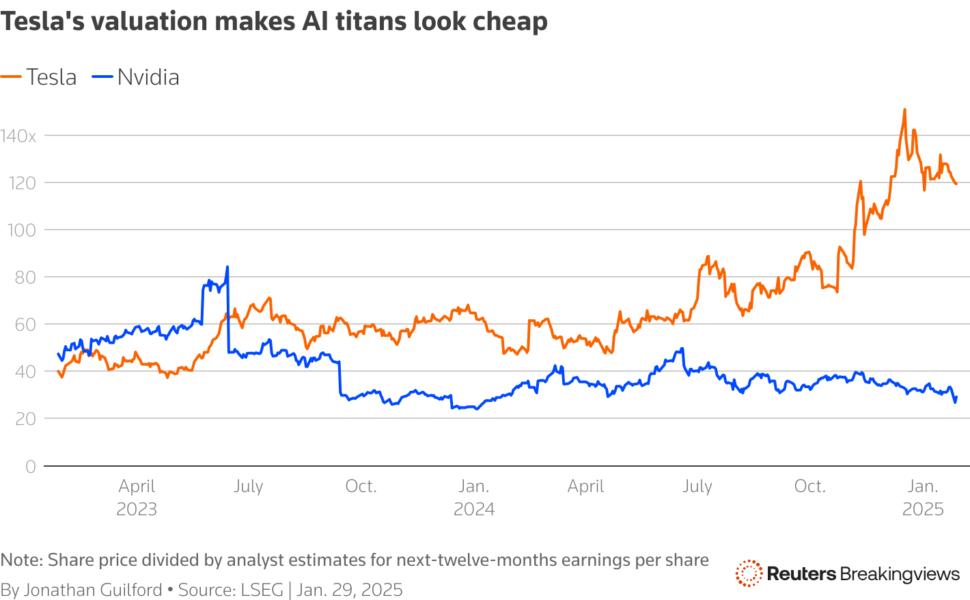

Although investors are counting on total success, based on the valuation multiple of 120 times expected earnings for the next 12 months, there’s a long way to go. Meanwhile, the car business is undeniably slowing, with analysts expecting Tesla to fall considerably short of a 20% sales growth target, according to Visible Alpha. Given all the distractions and disturbances, it may be safer for Musk to consider enlisting some cruise control.

Follow @JMAGuilford on X

CONTEXT NEWS

Tesla said on Jan. 29 that its fourth-quarter gross profit margin from vehicle sales, excluding regulatory credits, fell to 13.6%, below the roughly 16% that analysts were expecting, according to Visible Alpha, and the 30% peak it achieved in 2022.

The electric-car and battery-pack maker led by Elon Musk generated $25.7 billion of revenue during the quarter, a 2% increase from the same period a year earlier, but 6% less than was anticipated.